June 2023

Relative Stock Market Valuation

Even as remaining order backlogs mask the desolate situation, the German industry is sliding ever deeper into recession. The Ukraine war and high energy prices are further burdening local growth. The same can be observed in several other economies. However, many undervalued companies still suggest a lot of potential upside in equity markets (melt-up boom), especially if central banks return to expansive monetary policy.

In this ambiguous environment, flexibility is key: with an equity allocation of 64%, 26% in cash and short term government bonds, and 10% in precious metals, we will participate in rising markets with our contrarian mutual fund Huber Portfolio SICAV while keeping sufficient dry powder for counter-cyclical purchases. In memory of the tech bubble of 2000, we avoid overhyped AI companies and invest in undervalued quality stocks, particularly in the energy and raw materials sectors and in Asia, but also in select emerging markets.

Why are we investing heavily in the Asia region?

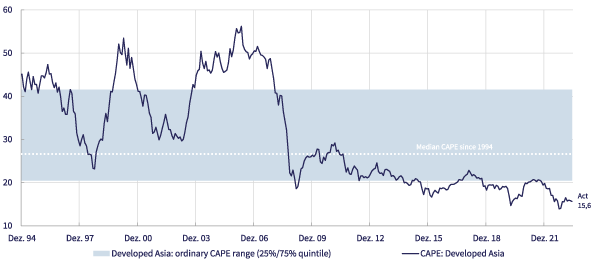

From a valuation perspective, the stock market for developed Asian economies, dominated by Japan, seems particularly interesting. Asian stocks, which have historically been valued with an average Shiller CAPE of 26.6 since 1994, currently trade about 40% lower, at 15.6. Since 1994, with the exception of the pandemic-caused lows in March 2020, Asian stocks have never been more attractive than they are today. Moreover, the underlying economies offer attractive growth potential, benefitting from the reopening of China but also the „friend-shoring“ of western nations, which aim to lower their dependance on China. This will lead to increased construction of additional infrastructure in the region und should benefit particularly export-oriented Japanese machine builders, but also other Asian capital goods manufacturers, e.g. in Korea.

Asia CAPE is significantly below historical averages and near all-time valuation low

Taking into account not only the Shiller CAPE but also the price-to-book ratio, developed Asian stock markets are currently trading 24% below their historical average valuations. No region is currently valued more attractively – at least if one excludes Eastern Europe equities distorted by the Russian market. Reason enough for us to continue increasing the Asian holdings in our portfolios – and already today, a quarter of the stock holdings in our contrarian mutual fund Huber Portfolio are in developed Asian economies.

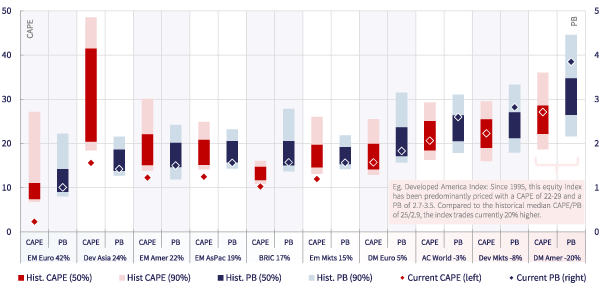

Regional valuation: only Asia and Emerging Markets undervalued

Besides developed Asia, only the emerging countries in Asia and South America still offer significant undervaluations, while North American stocks dominated by the US market are trading 20% above their long-term average valuations. European stocks are valued similarly to the last three decades.

In general, stocks from emerging countries appear very attractive, especially as they are currently being „left out“ by many investors after years of significant underperformance. This is probably a mistake, as companies from emerging countries offer inherently more growth potential, especially in their home markets (it’s easier to grow from a small base). They should also benefit from investment efforts for alternative production infrastructure in the West (“friend-shoring”) and have increasingly adopted a more capital market-friendly orientation in recent years.

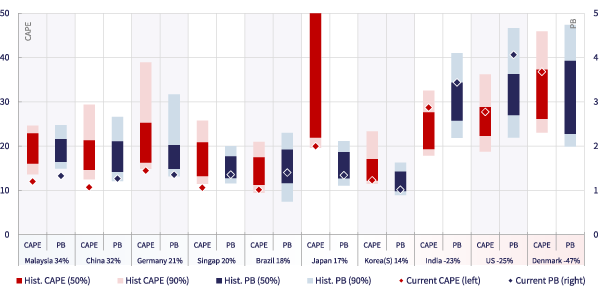

Which countries offer the biggest undervaluations compared to their own history?

Since there are usually significant valuation differences at the country level within the regions, the following graph compares selected individual countries. It shows that the favorable valuation of the emerging markets is particularly due to the undervaluation of countries like China, Malaysia, Singapore, Brazil, and Korea. These countries are currently valued 14%-34% lower than in the past decades. In contrast India, for example, is trading 23% higher than in the past.

Countries: which large countries are currently particularly cheap to buy?

In Europe, too, there are considerable valuation differences between individual countries: German stocks are still 20% cheaper while, for example, Danish stocks appear extremely expensive. This underlines that outside of the USA, numerous interesting buying opportunities are emerging, at least if regions are not being replicated benchmark-oriented via ETFs, but rather country allocation is actively managed. Germany, in particular, continues to offer attractive opportunities for investors focused on Europe. While Germany is increasingly suffering from misbegotten government policy that particularly burdens the manufacturing industry, all complainants about German politics should remind themselves that similar assessments are probably commonplace in all (European) countries. And many German companies are often „global players“ with a leading worldwide market position, generating the majority of their business outside Europe. Their significant valuation discount to global competitors is thus unjustified, as these companies will reposition themselves according to new realities and consequently suffer much less than the economy and society of our homeland.

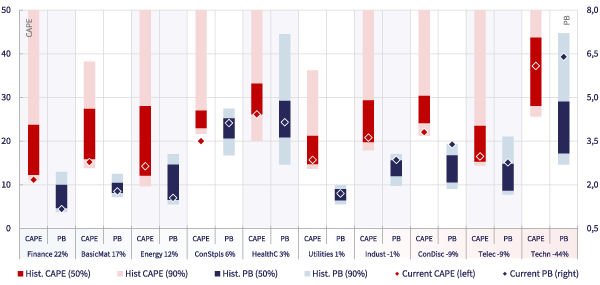

Which sectors offer the biggest undervaluations compared to their own history?

At the sector level, resource and energy stocks, as well as financials, are currently significantly undervalued compared to the last three decades. Investors can buy into these sectors 12-22% cheaper than in the past.

Sectors: which sectors are currently particularly cheap to buy?

Technology stocks, on the other hand, appear significantly less attractive: although technology stocks have been valued significantly higher than other sectors since 1994 due to above-average earnings growth rates, they have rarely been as highly valued as they are today.

For this reason, we do not join the current hype about technology stocks, especially those with presumed growth potential coming from the current revolution in Artificial Intelligence (AI). We are sure that AI will greatly change our society, but we find it hardly possible to identify winners and losers at this early stage of development and monetization, as well as to quantify the resulting additional earnings potential through AI. What can be quantified, however, is investor enthusiasm in this regard, visible in the high valuations of various stocks. The current “buzz” strongly reminds us of the „Internet bubble“ at the beginning of the millennium, but also of the stock developments of the 20th century in the context of various other technological advances such as the spread of automobiles or air travel. In these past time periods, there were also strong societal changes, many short-term stock market winners, but often only very few companies that ended up asserting themselves and earning money, not infrequently companies that only appeared on the scene after the first „hype“ faded.

Many greetings from Bad Homburg,

David Meyer & Norbert Keimling

David Meyer

Portfoliomanager

Norbert Keimling

Portfoliomanager

Presseartikel "Die großen Reichmacher"

„Vielleicht sind es nur wenige, aber es gibt sie wirklich: Top-Fondsmanager, die es schaffen, mit ihrer Performance ihre Vergleichsgruppe langfristig dauerhaft zu schlagen. Da es auch viele schlechte Fonds gibt, lohnt es sich für Anleger in Heller und Pfennig, auf diese ausgewählten Fondslenker zu setzen. „

Zum Artikel (Börsenzeitung vom 08.05.2023)

Video: Krisen als Chance

Norbert Keimling geht in diesem Videomitschnitt vom FONDS professionell Kongress in Mannheim darauf ein, weshalb gerade Krisenzeiten Chancen bieten und wie wir diese im Fondsmanagement des Huber Portfolio SICAV und des TT Contrarian Global nutzen.

Further information

Huber Portfolio SICAV

The Huber Portfolio SICAV is an opportunity-oriented, wealth management fund that follows a contrarian investment strategy.

Investor Update

Would you like to be regularly informed about our market opinion and events? Then feel free to use our subscription service (in German).

TT Contrarian Global

The TT Contrarian Global is an opportunity-oriented international equity fund that follows a contrarian investment strategy.