July 2023

Dangerous Concentration Risks in Benchmarks?

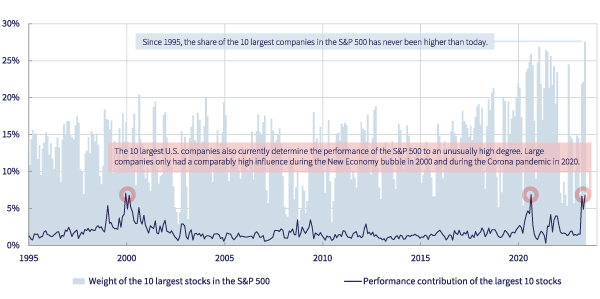

The ten largest U.S. stocks such as Apple, Nvidia and Tesla now account for more than a quarter of the S&P 500 Index. The remaining 490 companies have to share what’s left. A comparably high concentration has never been observed in recent decades. The impact of these mega-caps, which are currently dominated by fast-growing technology stocks, on the performance of the S&P 500 is also close to an all-time high. Comparably high performance contributions from large companies were last measured only in 2000 and 2020.

Dangerous Concentration Risks: Few Stocks Dominate Indices

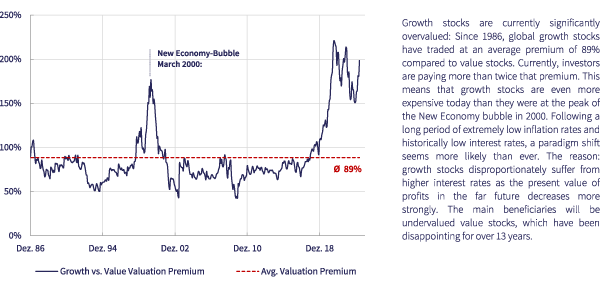

High index concentrations are usually not beneficial for investors, because it usually indicates an overvaluation of large companies. Such an overvaluation is currently evident in large, fast-growing technology corporations: While growth stocks have traded on average at a valuation premium of 89% compared to value companies since 1986, this premium is currently around 200%. This means that growth stocks are currently even more expensive than at the peak of the New Economy bubble in 2000.

Valuation Premium of Growth at Extreme Levels

The high index weighting of expensive technology stocks is thus not the result of impressive earnings growth, but rather the consequence of a euphoria-driven valuation expansion. However, this cannot continue forever, neither in theory nor was it observed in history: Above-average growth rates and profitability could never be sustained over the long term, even in past technological innovation phases such as the introduction of industrial mass production, eventually rightsized through competition, widespread adaptation of new technologies in traditional companies or regulation.

Disrupted supply chains, which affect the technology sector severely, the long-neglected dangers of too much technological dependence on a few big companies, and the ever louder calls for stronger regulation of the technology sector, which is characterized by a „the winner takes it all“ competitive spirit, harbor considerable potential for disappointment in numerous growth stocks that have hardly been priced in so far. The consequences of credit-financed share buybacks at exorbitant prices or the short-lived nature of many business models in this disruptive period are presumably neither reflected in the high valuations.

Moreover, a paradigm shift in the pricing of growth after a long period of extremely low inflation rates and historic lows in interest rates seems more likely than ever. Not only because of the high valuation of growth stocks, but also because they suffer disproportionately from higher interest rates, as the present value of profits that lie in the distant future declines more strongly.

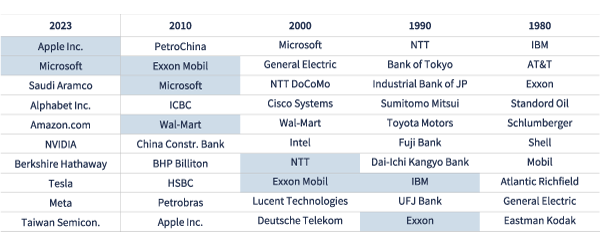

From an empirical point of view, too, it seems unlikely that today’s stock market darlings in the technology sector will retain their supremacy over the longer term. If we look at the ten largest companies of the last decades, for example, we see that on average just two companies remain among the largest 10 in the following decade. The others drop out of the top 10, in particular due to underperformance.

The World's Largest Companies Change Permanently

Based on historical experience, 8 of the world’s 10 largest companies today are likely to have disappeared from this ranking by 2030. This departure is usually accompanied by a below-average performance, as in the case of Deutsche Telekom in 2000 for example.

According to Research Affiliates research, investors who invested in each of the world’s ten largest companies from 1980 to2017 achieved an annual performance of just 6.3%. By comparison, the world stock market gained 9.7% over the same period. This corresponds to an underperformance of 3.4% per year. An investment in the world’s single largest company was even more disappointing, with a value increase of only 1.0% p.a. and an underperformance of 8.7% p.a. respectively.

What could end the current run of triumph of expensive megacaps?

The ETF boom of recent years has additionally increased the outperformance of large technology companies, as the majority of ETFs weight their stocks by market capitalization or free float. Large companies therefore benefited disproportionately from high ETF inflows. Should the dazzling mega-caps ever disappoint, ETFs would suffer particularly badly for this reason. As soon as investors reduce ETFs with particularly large concentration risks, this spiral can also reverse quickly. Initial selling pressure on mega-caps is likely to come from the recently announced adjustment of the NASDAQ 100: after the rapid rise of the largest five U.S. technology stocks (Microsoft, Apple, Nvidia, Amazon, Tesla), they now account for more than 40% in the NASDAQ 100. This prompts Nasdaq Inc. – for the first time in its history – to carry out a „special rebalancing“ to reduce the index weighting of the heavyweights before the end of July. This could increase selling pressure and fuel the whole concentration risk debate.

For us, this is reason enough to avoid overvalued mega-caps and index-related strategies with high concentration risks, especially as there are currently countless attractively valued companies on the stock market besides the current investor darlings.

Many greetings from Bad Homburg,

Peter E. Huber & David Meyer & Norbert Keimling

David Meyer

Portfoliomanager

Norbert Keimling

Portfoliomanager

Research "Relative Stock Market Valuation"

„Taking into account not only the Shiller CAPE but also the price-to-book ratio, developed Asian stock markets are currently trading 24% below their historical average valuations…“

Read More (Investorupdate June 2023)

Video: Krisen als Chance

Norbert Keimling geht in diesem Videomitschnitt vom FONDS professionell Kongress in Mannheim darauf ein, weshalb gerade Krisenzeiten Chancen bieten und wie wir diese im Fondsmanagement des Huber Portfolio SICAV und des TT Contrarian Global nutzen.

Further information

Huber Portfolio SICAV

The Huber Portfolio SICAV is an opportunity-oriented, wealth management fund that follows a contrarian investment strategy.

Investor Update

Would you like to be regularly informed about our market opinion and events? Then feel free to use our subscription service (in German).

TT Contrarian Global

The TT Contrarian Global is an opportunity-oriented international equity fund that follows a contrarian investment strategy.